7 Ways How To Apply For Financial Aid For College

The application process for college is not easy. Not only do you need to get accepted, but the next step can be just as challenging financially. Thankfully there are many sources of financial aid that help students pay for school and funding your collegiate career doesn't have to be difficult! In this guide, we cover how you can apply for financial aid to fund your future education with ease.

If you want to make your way through the college admissions process, then it's time for a crash course on financial aid. In the sections below, we discuss two types of financial aids: need-based and merit-based. Need-based is given out according to student income levels or their family size; whereas Merit-Based is not related at all with finances but rather depends solely on grades). It can be daunting trying to decide which type will work best for you - so in this article, we provide step-by-step answers on how to get either one!

|

| How To Apply For Financial Aid For College |

You Must Know Before Applying for Financial Aid

Financial aid can be broken down into two categories: Need-based and Merit-based. Each type has a different set of financial aid application forms, deadlines, and requirements for consideration.

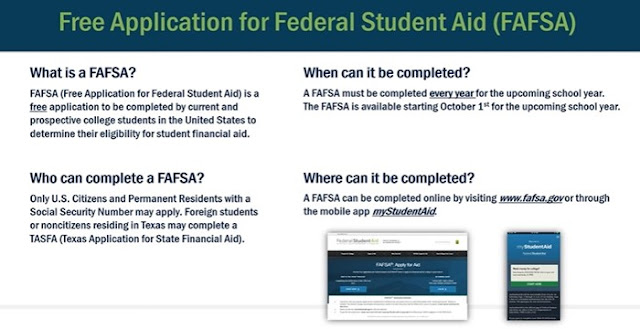

Need-based aid is determined by how much a student's family can afford to pay, as well as the total costs of going to college. To determine this amount and apply for need-based financial aid from the federal government or state governments, students must fill out an application called FAFSA which stands for Free Application For Federal Student Aid. The numbers on their FAFSA are used to calculate "expected family contribution" (EFC).

You would think that the CSS/Financial Aid PROFILE form was only for use with private colleges, right? Well, you're wrong; 200 mostly public universities also rely on this document to award their own financial aid funds. These schools must still submit a FAFSA to receive federal and state grants but they can apply all of these college’s scholarships solely through the Profile Form.

Merit-based aid is awarded to students based on their academic, artistic, or athletic talents. Providers of private scholarships each have different application requirements and forms which make them difficult for some people to access.

A new wave of merit-based aid is starting to take over the higher education landscape. Colleges are doling out scholarships and grants based on students' grades, test scores, and other quantifiable achievements. What does this mean for you?

If you want to improve your chances of getting a scholarship or grant from your school, start by looking up the requirements that they ask for in order to be eligible. You can also contact them directly if you have any questions about what they're looking for! The more information you have about what makes someone a strong applicant, the easier it will be to apply and get accepted into college.

How to Apply for Financial Aid for College - A Step by Step Guide

Complete Step-by-Step Guide How To Apply For Financial Aid For College. You're in college and you need to apply for financial aid. Follow these steps before the deadline:

|

| Apply For Financial Aid For College |

1. Create an FSA ID

The FSA ID is a statement of identity for the U.S Department of Education and its various online applications, including FAFSA. This signature system ensures that all information can be securely processed without fear or worry from hackers, by using your unique credentials to sign in digitally!

In order to get an FSA ID, visit https://fsaid.ed.gov/npas/. The student and parent need each of their own FSA IDs before they can start using FASFA for the first time!

File the FAFSA

- File your FAFSA as soon as possible to maximize the amount of aid for which you are eligible. Visit www.fafsa.ed.gov and file your form on or after October 1st, in order to be considered by colleges when they award need-based financial aid packages next year!

- Filing the FAFSA is a must for students who want to attend college. If you file late, there's no guarantee that your state will award you with any grants or scholarships because so many deadlines are on a first-come-first-serve basis.

- Start your FAFSA with the IRS Data Retrieval Tool to transfer income and tax information from your federal income tax return. This will simplify the application process, cut down on time spent completing it so you can get back in bed sooner, and reduce the chances of being selected for verification.

- As part of the FAFSA process, you may be required to print a confirmation page that includes your EFC. This will typically happen once you have completed filing online and provided an email address for communication purposes. The Student Aid Report (SAR) should arrive within two weeks after completion.

2. Complete the CSS Profile

If your college requires the CSS/Financial Aid PROFILE form, then you should file it on css.collegeboard.org before they make a decision about whether or not to accept you for enrollment as their student!

3. Verification For The FAFSA

When your FAFSA is selected for verification, do everything you can to complete the process quickly. Colleges are not allowed to disburse financial aid funds until all of their student's information has been checked and verified by authorities at both schools as well as the federal government.

4. Evaluating Your Financial Aid Award Letter

The financial aid award letter outlines what kinds of funding you can expect. Be careful to distinguish grants from loans when calculating the net price. Subtract just the gift-aid amount for a better idea of how much money is needed in order to attend, but remember that other factors such as tuition and pricing are taken into account too so make sure not forget about those before making any decisions!

Gift aid is when you receive money for your education that does not need to be earned or repaid. The cost of attending a college includes tuition and fees, room and board, books, supplies, transportation as well as miscellaneous expenses.

so it's important to make sure these costs won't put too much strain on either the family savings account or income streams before agreeing to attend an institution because if there aren't enough resources available then they might want will have trouble affording their education in the full-time undergraduate program!

5. Appeal for More College Financial Aid

Have you been working hard to save for your education? Did not know that certain circumstances might affect how much aid they can give you on the FAFSA. There are special circumstances that may change in a short period of time, such as job loss or child care changes. If this happens and it affects your family's ability to pay then contact them immediately so they can review their decision with professional judgment before things get worse!

6. Search for Scholarships

The struggle of paying for college can be overwhelming. Luckily, there are some ways to make it easier! One way is by using free websites that provide scholarships and information on different financial opportunities available in a particular field of interest.

When filling out scholarship applications online, answer as many questions as you want so more matches will come up - but beware: if the site wants money from you after applying (as opposed to giving awards), then don't proceed any further because these sites may not have your best interests at heart; they're probably just scams trying to take advantage of people who need help funding their education.

To avoid being duped into wasting time submitting applications where no award exists whatsoever, check with colleges about outside scholarship policies before sending anything off.

7. Financial Aid Apply Every Year

Financial aid can be a complicated and mysterious process. If you were offered only loans last year, then there is hope that this will not happen again! Financial aid formulas are very complex and often depend on family circumstances or changes in these circumstances.

For example, if the student's assets have been depleted from attending college for a while now while their parents' assets remain strong - they may become eligible to receive more assistance through financial scholarships available exclusively to students already enrolled in school.

Post a Comment for "7 Ways How To Apply For Financial Aid For College"